Nowadays the buzz word in equity investing seems to be diversification and globalization. Every news channel that you see will be awash with pundits describing the benefits of diversification, and exposure to international equity as one such avenue. But this is something I wanted to check out and figure for myself. The best way would be to simply compare the performance of the Indian stock markets vs a major international stock index, and the obvious one that comes to mind is the US stock market. So I set out to compare the performance of the NIFTY 50 as a proxy for the Indian stock markets, vs the DOW JONES Index, which is a proxy for the US stock markets. This analysis is useful in 2 scenarios. There are several NRI investors who struggle to decide whether to keep their investments in the US, or deploy them back home in India. There are also India based investors wanting to get a piece of the US market action in the name of diversification. Both these investors are looking for the same thing, which is the best returns on their investment Dollars or Rupees. In this article I have attempted a simple comparison of the US and Indian stock markets, by contrasting the NIFTY vs the DOW. The results certainly surprised me! Why don't you take a look for yourself here.

To start with I picked the NIFTY and the DOW as representative of the respective countries stock market performance. This is somewhat debatable, but we will use this for starters, and refine further later if needed.

The next step was to dig up the historical data for these indices for several years into the recent past. Now remember that to do an accurate comparison we need to use the total returns index, and not the commonly reported index values for both indices. I don't intend to describe the Total Returns Index concept here (maybe in a separate blog post), but you can read up about it in the link I have provided. Suffice it to say for now that the total returns index is the right way to do this comparison. Surprisingly it was not easy to find the historical values for the total returns indices. The best I could do was go back about 11 years. If you know of a data source which provides values going back about 30 years, please send it across my way, and I would be happy to extend this comparison. For now we will just live with the 11 years data I have been able to find.

In the table above, I have listed the starting value of the Index for each year, and the returns given by the index in that particular year. For example in the first row for 2004, the DJIA started at 15811, and gave a total return of 5%, when compared to the NIFTY which started at 2177, and gave a return of 13% in that year. Again please remember that these index values are total return values and not the regular index values commonly reported in the media. The comparison will focus on 11 years from 2004 to 2014. Obviously for 2015, I don't still have the complete year data.

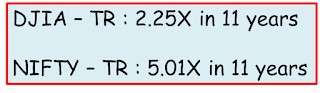

This side by side comparison shows the NIFTY trumping the DJIA in 8 of the last 11 years, many times by a large margin. Of course in the remaining 3 years, the DJIA seems to have pulverized the NIFTY in equal measure! Cumulative across the 11 years, here are the numbers to focus on for the 2 representative indices.

The DJIA has zoomed by a large amount from 2004 to 2014, but the NIFTY has been simply outstanding in the same time period. In percentage terms, the below figures clearly show the out performance of the NIFTY when compared to the DJIA.

The NIFTY has done more than twice as well as the DJIA in percentage terms over the last decade! Clearly the Indian investor will be much happier with his/her investments in the Indian stock market when compared to the US investor.

However what we really need to compare is the performance of these 2 indices normalized to the same base currency, since there are also significant currency fluctuations that have occurred over the last decade. In particular, the Indian Rupee has devalued spectacularly when compared to the US Dollar, which will eat away into the real gains made in the Indian index. The below table includes the USD 2 INR conversion rate at the beginning of each calendar year

The percentage return in the last column indicates how much the USD has appreciated wrt the INR in that particular year. For example in 2009, while the NIFTY gave 74% returns compared to 21% in the DJIA, the USD-INR barely moved and in fact is 0.96, which means the INR actually marginally strengthened in that particular year. So all of the NIFTY out-performance for 2009 was real when compared to the DJIA. Conversely in 2011, not only did the NIFTY under-perform the DOW -24% to 9% (overall 33% lower), but the INR also weakened by 19% when compared to the USD, which means overall roughly 33 + 19 = 52% under-performance! 2011, was clearly a bad year to be in the Indian stock market, further compounded by the fact that the DOW did really well!

In fact over the 11 years from 2004 to 2014, the INR devalued from 45.66 to 63.16, a loss of nearly 40%, which the NIFTY would have to recover to be comparable to the DOW performance. So assuming a $10,000 USD investment in the DJIA, would result in $10,000 x 2.25 = $22,500 in 2014 at the end of 11 years, which would be $22,500 x 63.16 = Rs 14,21,100 in INR. The same $10,000 USD if invested in 2004 in the NIFTY, would be $10,000 x 45.66 = Rs 4,56,600 invested, growing 5.01 times to Rs 4,56,600 x 5.01 = Rs 22,87,566. So even after taking the INR devaluation into account, the NIFTY in real terms has out performed the DJIA by a factor of 1.61X (Rs 22,87,566 vs Rs 14,21,100)

61% is a thumping beating that the NIFTY has handed out to the DJIA in 11 years. Massive by any stretch of imagination. Now of course the Indian stock markets saw a mega-bull run from 2003 to 2007 some of which has been captured in the comparison duration in this post. Like I said earlier, I would be happy to extend the analysis if you can point me to additional data for the NIFTY and DJIA.

For the last decade though, the conclusion is crystal clear, the NIFTY is the clear winner by a large margin. If you are an India based investor, you need'nt have worried too much about diversification atleast in the last decade. Your own home market did wonders racing up by 5.01 times in 11 years when compared to 2.25 times for the DOW. The relative out-performance including currency fluctuations was still a handsome 61%. If you were an NRI investor in the US, you missed out the last decade if you were not heavily invested in India. The NRI investor has several avenues to participate in the India story, either through direct investments in the Indian stock market (though recent FATCA rules make this somewhat difficult) or through US based MFs and ETFs that track the emerging market story in India. The key question is, did you see this trend coming up, and did you take full advantage of it. If not, you missed a golden opportunity here.

With the new Modi wave, I will wager there is another golden decade of out-performance coming your way for the NIFTY when compared to the DOW. Are you going to join in and participate this time around?

Finally, I want to point out that though I have used the NIFTY and DOW as respective proxies for the corresponding stock markets, in reality investors rarely park all their money in index tracking instruments. Typically investments are either in MFs or in direct equity. In a following post, I will try to bring out that additional difference between the 2 markets. If there are any different metrics you'd like to see in the comparison, please let me know, As always do let me know if you agree with the logic of the analysis presented here, and if you find any data inaccuracies, please do point it out, so I can fix my math and conclusions as needed.

Figures are very impressive. Rs depreciation is dilute the Nifty outperform in $ term.

ReplyDeletevery nice article.

Free trade is not basede on utility but on justice. Free Intraday Tips

ReplyDelete